Top Green Energy Stocks to Invest in 2025

As India accelerates its transition towards cleaner energy, green energy stocks are becoming increasingly attractive for long-term investors. The government’s push for sustainability, paired with rising awareness among consumers and businesses, has made green energy a hot sector in the stock market. If you’re looking to diversify your portfolio with future-ready assets, renewable energy stocks deserve a top spot on your watchlist.

This blog explores the list of green energy stocks in India that are expected to outperform in 2025, along with insights into green energy stock price movements, market trends, and green energy penny stocks with potential.

Why Invest in Green Energy Stocks?

Green energy isn’t just a buzzword—it’s a crucial part of India’s strategy to reduce its carbon footprint and achieve net zero by 2070. The sector includes companies involved in:

- Solar power

- Wind energy

- Hydro-electricity

- Bioenergy

- Hydrogen fuel

- Battery storage and EV infrastructure

Investors now view green energy stocks India as not just environmentally responsible choices but also lucrative financial opportunities.

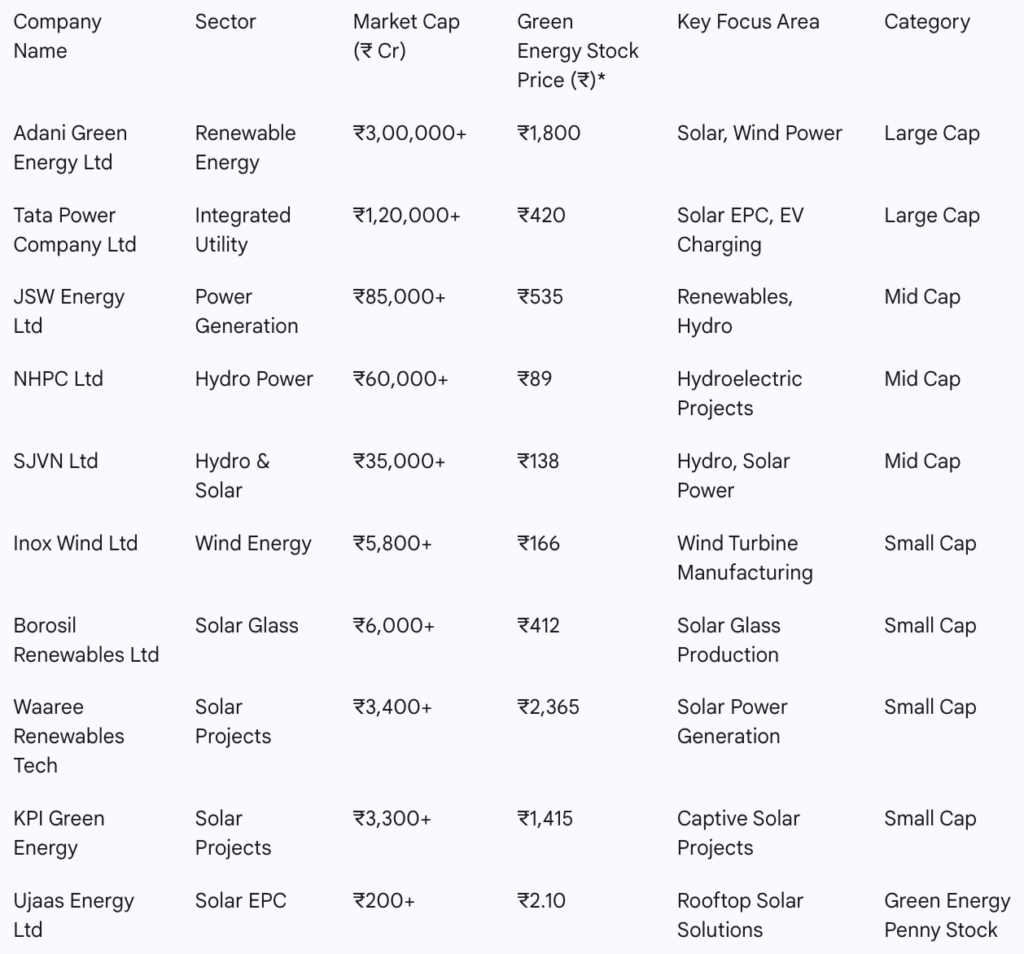

Top Green Energy Stocks in India to Watch in 2025

Here’s a comprehensive list of green energy stocks in India to consider for investment in 2025:

*Prices are approximate and as of April 2025.

Analysis of Green Energy Penny Stocks in India

For those with a higher risk appetite, green energy penny stocks can offer multi-bagger potential, albeit with higher volatility.

Ujaas Energy Ltd: Once a leader in rooftop solar installations, Ujaas has faced business headwinds. However, with renewed government subsidies for rooftop solar, the stock may rebound.

Urja Global Ltd: Trading under ₹30, Urja Global focuses on EV batteries and solar power products. Investors should watch for updates on partnerships and product innovation.

Websol Energy System: A solar cell and module maker, Websol is re-aligning operations to meet demand under India’s “Make in India” and PLI schemes. Currently priced under ₹100, it may be considered speculative but promising.

These stocks are great for investors looking to tap into renewable energy stocks with lower capital.

Trends Driving Growth in Renewable Energy Stocks

1. Government Policies & Incentives: India’s Ministry of New and Renewable Energy (MNRE) offers multiple schemes—Production Linked Incentives (PLI), Viability Gap Funding, and Green Hydrogen Mission—which directly benefit listed renewable energy firms.

2. Corporate Sustainability Goals: Corporations are aiming for net-zero targets, boosting demand for green electricity from providers like Adani Green, Tata Power, and JSW Energy.

3. Foreign Investments: FDI in the green sector continues to rise. In Q1 of 2025, over ₹10,000 crore was invested in Indian green tech and solar companies, creating bullish momentum for green energy stocks India.

4. Global Climate Commitments: COP28 and global green pacts are pushing nations to decarbonize faster, bringing capital and innovation into India’s energy ecosystem.

Green Energy Stocks India: Sector Breakdown

Let’s look at various categories within the list of green energy stocks in India:

Solar Energy Stocks

- Adani Green

- Borosil Renewables

- KPI Green Energy

- Waaree Renewables

Wind Energy Stocks

- Inox Wind

- Suzlon Energy (penny stock with volatility)

Hydroelectric Power Stocks

- NHPC

- SJVN

EV and Battery Support Stocks

- Tata Power (EV charging infra)

- Urja Global (Battery solutions)

Green Energy Penny Stocks

- Ujaas Energy

- Websol Energy

- Urja Global

Each of these has a different risk-reward profile and market segment exposure.

Performance Snapshot: Green Energy Stock Price Trends

Here’s how select green energy stock price movements have performed YTD (Year to Date 2025):

Note: Historical performance is not indicative of future returns.

Future Outlook for Green Energy Stocks in India

India aims to install 500 GW of non-fossil fuel capacity by 2030. That includes solar (280 GW), wind (140 GW), and hydro (60 GW). This roadmap directly benefits all the stocks listed above and continues to attract FII and DII interest.

By 2025–26, green hydrogen, battery storage, and offshore wind will become key themes, opening opportunities in adjacent segments. Watch for IPOs and new listings in these areas.

Final Thoughts

Investing in green energy stocks India is not just an ethical choice—it’s also a smart financial decision. As clean energy adoption rises, both institutional and retail investors can benefit from the sector’s structural tailwinds.

Whether you’re investing in blue-chip renewables like Adani Green or looking at green energy penny stocks like Ujaas Energy for higher returns, 2025 presents a unique entry point into India’s clean energy revolution.

Frequently Asked Questions (FAQs)

Green energy stocks in India refer to publicly traded companies that generate revenue from renewable sources like solar, wind, hydro, bioenergy, or clean technologies such as EV charging and green hydrogen. Examples include Adani Green, Tata Power, and Borosil Renewables.

Some of the top renewable energy stocks for 2025 include:

Adani Green Energy – for solar and wind power

Tata Power – for solar EPC and EV charging infrastructure

JSW Energy – for hydro and solar mix

Borosil Renewables – for solar glass manufacturing

These companies have strong fundamentals, growth potential, and government backing.

Green energy penny stocks like Ujaas Energy, Urja Global, and Websol Energy may offer high returns but come with greater risk and volatility. Investors should conduct thorough research or consult financial advisors before investing in them.

You can track green energy stock price movements on platforms like:

NSE/BSE official websites

Trading apps like Zerodha, Groww, or Upstox

Financial portals such as Moneycontrol or Economic Times

Prices fluctuate daily based on market demand, news, and sector trends.

There are multiple reasons:

Government push for clean energy

Global investment in sustainable sectors

Corporate ESG (Environmental, Social, Governance) targets

Increasing demand for electric vehicles and solar adoption

These trends make green energy stocks India an attractive long-term play.